Deciding to stay in college to prepare for a better future, or instead, take on more work to provide for immediate financial needs, is a difficult dilemma, especially amid the hardships of the worldwide COVID–19 pandemic.

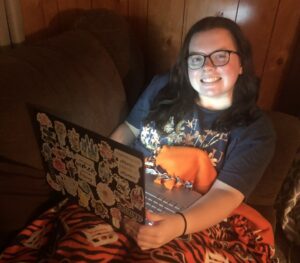

MCCC student Emilee Breitner said when MCCC went virtual she had to share laptop with her sister to complete schoolwork which was a challenging arrangement.

She said she was relieved when MCCC provided funds to purchase her own laptop.

She said it allowed her the freedom to complete course work and tutor MCCC students as a writing fellow.

MCCC has made more than $650,000 available to MCCC students with the sole purpose of alleviating financial strain and supporting student success.

The funds, allocated by the U.S. Department of Education, were provided through The Coronavirus Response and Relief Supplemental Appropriations Act (CRRSAA).

According to the news release, the $650,000 Higher Education Emergency Relief Fund II was part of a $1.3 million allocation through the Coronavirus Response and Relief Supplemental Appropriations Act.

In accordance with the act, half is to be given directly to students, and the remaining $650,000 is to be used for institutional costs, including technology costs needed for the virtual leaning transition, payroll and lost revenue, incurred because of COVID-19.

CRRSAA is a federal emergency grant meant to prioritize students in the greatest financial need.

Student financial needs include tuition and books, but also housing, food, health care, childcare and technology needed for online courses, according to the news release.

The emergency funds help students with the day-to-day expenses not always associated with being a college student, said Scott Behrens, vice president of Enrollment Management and Student Success.

MCCC has found that many students are struggling as COVID-19 impacted their work schedules and especially social and mental health, said Behrens.

Despite this, MCCC has not seen rising dropout rates, he said, explaining this could be attributed to MCCC’s ability to provide resources that help students when they face financial need.

With certain monetary issues out of the way, he said, students are not forced to drop out due to work conflicts and can focus on the goal of completing their degree.

Behrens said, “It’s great to be able to say, ‘Hey. It’s OK. We’ve got you covered.’”

In order to be considered eligible for assistance, MCCC students must have a current FAFSA on file. A FAFSA form can be filled out at www.fafsa.gov.

Director of Financial Aid, Valerie Culler, said the MCCC task force determines the students who are in greatest financial need based on the Pell Grants they qualify for.

Students who qualify for the maximum Pell Grant demonstrate the greatest need and could receive up to $2,000. Students who qualify for partial Pell Grants could be awarded a maximum of $1,500.

Students who do not qualify for federal assistance but identify with having exceptional need, Culler said, can still apply and receive up to $1,000 of CRRSAA funds.

She said students who applied for the first round of emergency grants through CARES Act are still eligible for current CRRSAA funding.

The funds were first made available on March 5.

As of April 1, $396,259 of the grant has been awarded to 286 MCCC students.

Culler said applications will be open for one year or until the funds are completely gone.

The CRRSAA application can be filled out at www.monroeccc.edu/caresact.

Students can expect a follow-up email from Financial Aid after their application has been evaluated.

Jenna Bazzell, assistant professor of English, said when students confided financial emergencies that would prevent them from continuing at MCCC, she was able to direct them to an immediate solution through the CRRSAA funds.

“We do not want a short-term emergency to threaten the success of a student here at MCCC,” said Bazzell.

The CARES Act from the Higher Education Emergency Relief Fund was able to make a significant difference for many students.

The funds currently being distributed through CRRSAA is giving future financial security to students as they go forward with their academic goals, Behrens said.

Both Breitner and MCCC student Sidney Collino said they plan to use the CRRSAA funds toward future college expenses while pursuing their bachelor’s degrees next semester.

A rise in higher education attendance is anticipated by the government through the use of these federal funds said Behrens.

This can only occur if students take the initiative to apply, he said.

Breitner said, “Take the help where you can get it and don’t be embarrassed because you want to get further in life, and these people want to help you.”

“We want people to feel free to ask for the funds,” Behrens said. “We want to reach out and make sure that everybody knows that we are here for them and that there are real options to help them through this time.”