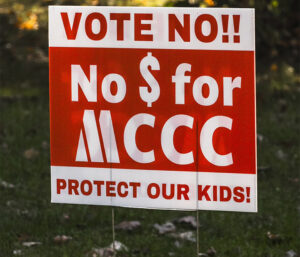

Monroe County has two millage rate proposals on the upcoming Nov. 5 ballot.

A millage rate is a tax determined by a property’s taxable value. Millage taxes often fund things like township tax, fire/police departments, museums. A portion of funding for public elementary, secondary, and college education institutions also comes from millage rates.

The first millage proposal aims to renew the current maintenance and improvement millage rate of $.85 mills. This rate is a zero-increase renewal. Homeowners can expect to pay the same amount they’re currently paying until 2030, should this renewal pass.

The second proposal on the ballot looks to restore the current operating levy from $2.1794 to its originally agreed upon amount of $2.25. Homeowners can expect a minor tax increase, should this override proposal succeed.

The amount saw a reduction after the Headlee Amendment entered the Michigan Constitution just two years prior to the passing of the 1980 operational amount in 1978.

The amendment protects people from unfair taxation. It prevents the millage rate from rising at times when the property rate increases faster than the rate of inflation. The rate can then only be restored by voters during election time.

The college’s 2024-2025 proposed budget says funding is decided based on the priorities of safety, accessibility, technology, updating the learning environment and deferred maintenance.

Joe Verkennes, director of marketing and communications, said he could not yet clarify how funding would be dispersed. He said the college is currently in the process of planning their phase three outline to allocate funds. Phase one and two saw changes and expansions to campus projects.

Former MCCC faculty member, Dale Parker, commented on the millage renewal during a visit to campus. Parker began work at MCCC in 1998 and retired in 2021.

“It’s very important everyone in Monroe County knows [the millage renewal will maintain its less than $4 per month rate if passed and not increase the rate] cause it’s for a good cause,” Parker said.

Lt. Gov. Gilchrist said projects and renovations are helpful to the college.

“Projects such as these expand the doors for opportunity and help residents become the best version of themselves in Michigan,” Gilchrist said while visiting campus for a groundbreaking ceremony.

The college currently levies a total of $3.0294 mills per $1,000 of taxable value on the homeowners, as reported by the Monroe County Equalization Department in the 2023 Apportionment report which can be found at https://www.co.monroe.mi.us/DocumentCenter.

If the millage renewal passes and the Headlee agreement override passes as well, the people will face a $3.1 ($2.25 restored operational rate + $0.85 renewal rate) mill rate.

The $0.85 rate would secure $6.7 million in funding for the college in 2026. The override would raise an additional $535,912 in its first year.

“I urge you to go out and vote. You know how to vote, and so support your college, because this is the only place where individuals in our community will have this opportunity,” said MCCC President Kojo Quartey.

For any questions regarding the millage, MCCC’s website encourages questions to be sent to Verkennes. He can be contacted at 734-384-4207 or emailed at jverkennes@monroeccc.edu.

Polls open for General Election on Tuesday, Nov. 5. Visit https://mvic.sos.state.mi.us to find out what else is written on your district’s ballot.